income tax calculator usa

Washington Income Tax Calculator Your Details DEC 23 2021 Overview of Washington Taxes Washington has no personal income tax. Fill in gross income and hours per week select the period and the salary after tax.

Property Tax Calculator Estimator For Real Estate And Homes

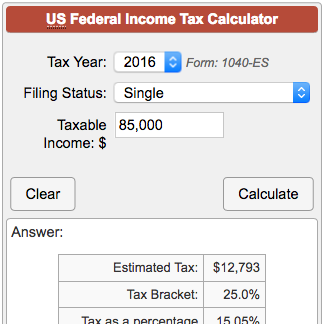

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

. Use this calculator to see if you can afford to buy that car. US Income Tax Calculator 2022 The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Prepare federal and state income taxes online.

Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. Also the standard deduction will increase in 2023 by 900 to 13850 for single filer or married but filing separately by 1400 to 20800 for head of households and 1800 to. Calculate the repayments on a personal loan.

Your bracket depends on your taxable income and filing status. There are seven federal tax brackets for the 2021 tax year. 10 12 22 24 32 35 and 37.

Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Our income tax calculator calculates your federal state and local taxes based on several key inputs. 218000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during.

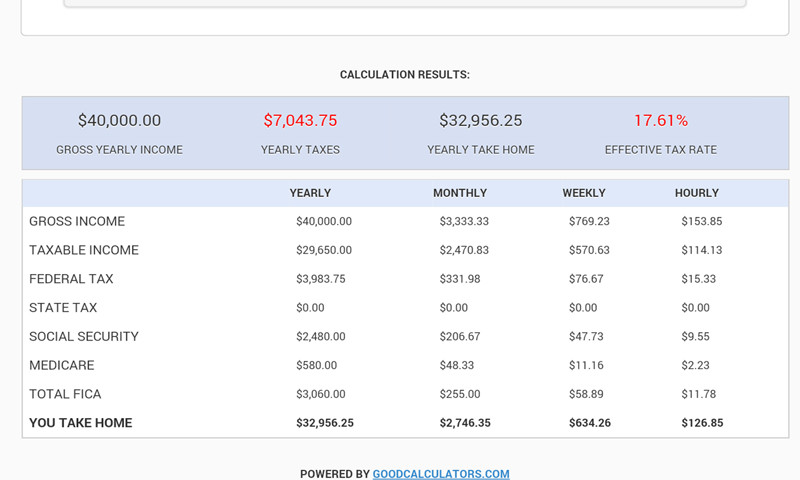

Income Filing Status State More options Calculate After-Tax Income 57688 0 20. US Income Tax Calculator is an online tool that can help you Calculate Salary After Tax USA. We use your income location to estimate.

2021 tax preparation software. See where that hard-earned money goes - with Federal Income. The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022.

Single filers may claim 13850 an increase. The tax calculator provides a full step by step breakdown and analysis of each. Free Income Tax Calculator - Estimate Your Taxes SmartAsset Calculate your 2019 federal state and local taxes with our free income tax calculator.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable income. Calculate Salary rate Annual Month Biweekly Weekly Day Hour.

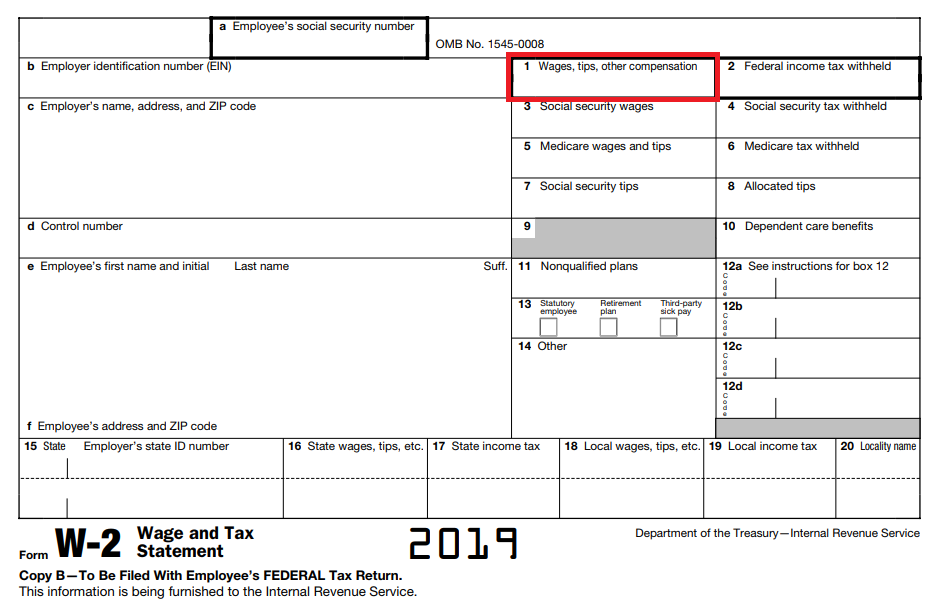

First enter your Gross Salary amount where shown. Efile your tax return directly to the IRS. Using the United States Tax Calculator Using the United States Tax Calculator is fairly simple.

Federal tax rates range from 10 to 37 depending on your income while state. Income Tax Calculator USA United States of America calculates federal taxes for year 2019 2018. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Some deductions from your paycheck are made. This Income Tax Calculator is updated for according to. Your household income location filing status and number of personal.

The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. About this app. The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and.

Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. The state has some of the highest. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Income tax calculator USA Find out how much your salary is after tax Enter your gross income Per Where do you work. Ad Calculate your tax refund and file your federal taxes for free. How to calculate Federal Tax based on your Annual Income.

100 Free Tax Filing. Next select the Filing Status drop down. Determine how a savings plan will boost your account.

The personal income tax rate in the US is progressive and assessed both on the federal level and the state level. Producing a tax return example or salary calculation is simple start by selecting a specific tax calculator that reflects the period for which you are paid or select annual to use your total. Subtract from the amount in 1.

Youll then get a breakdown of your total tax liability and take-home.

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Paycheck Calculator Take Home Pay Calculator

Income Tax In The United States Wikipedia

Usa Tax Calculators Apps On Google Play

Taxmode Income Tax Calculator Planner For Usa Amazon Com Appstore For Android

Taxmode Income Tax Calculator Planner For Usa Amazon Com Appstore For Android

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Free Gambling Winnings Tax Calculator All 50 Us States

Income Tax Formula Excel University

Paycheck Calculator Take Home Pay Calculator

The Consumer S Guide To Sales Tax Taxjar Developers

Github Pslmodels Tax Calculator Usa Federal Individual Income And Payroll Tax Microsimulation Model

Us Tax Rates For Crypto Bitcoin 2022 Koinly